Apple overtakes Samsung in global smartphone shipments

2 min read

In a historic shift, Apple surpasses Samsung globally in smartphone shipments, as reported by IDC and Canalys

In a significant 2023 development, Apple secures the top global spot in the smartphone industry for the first time, as revealed by recent data from IDC and Canalys on Monday and Tuesday. Following over a decade of Samsung’s dominance, Apple narrowly surpasses its rival to become the leading global smartphone vendor in terms of shipments.

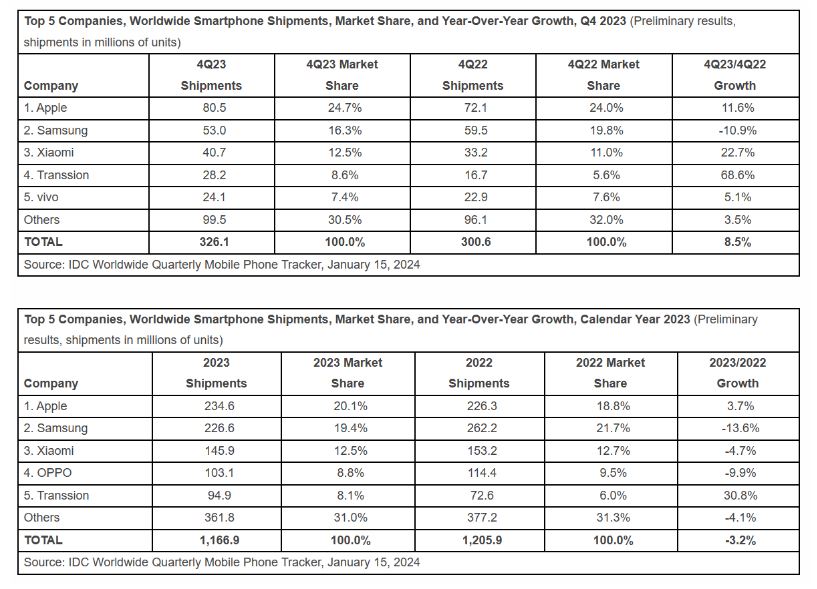

As per IDC, Apple delivered approximately 234.6 million smartphones in 2023, slightly surpassing Samsung’s 226.6 million. This represents a shift from previous years when Samsung held a dominant market position. IDC attributes Apple’s ascendancy to various factors, including robust demand for the latest iPhones and heightened regulatory obstacles for Samsung in China. Nabila Popal, Research Director at IDC, notes, “Although we observed substantial growth from low-end Android players like Transsion and Xiaomi in the latter half of 2023, the unequivocal winner is Apple.”

In Q4 2023, the smartphone sector experienced a rebound, surpassing expectations with an 8.5% year-over-year growth and 326.1 million shipments. Apple maintained its dominance in the fourth quarter, commanding a remarkable 24% market share, as reported by Canalys. Samsung secured the second position with a 17% share, while Xiaomi, Transsion, and Vivo completed the top five vendors. Canalys Senior Analyst Toby Zhu highlighted the growth driven by lower-priced mid-range devices, aided by the recovering demand in emerging markets.

The change follows a difficult 2022 for the smartphone sector. IDC notes a 3.2% global decline in smartphone shipments for the entire year 2023, reaching 1.17 billion units—the lowest volume in a decade. This decline was largely attributed to macroeconomic challenges and elevated inventory levels earlier in the year. However, the recovery observed in the latter half of 2023 indicates a more optimistic outlook for 2024. Zhu emphasized that, with inflation easing and supply constraints alleviating, vendors can now concentrate on innovation and long-term strategic advancements.

Several factors played a role in Apple surpassing Samsung. IDC highlights Apple’s record-breaking market share and its capacity for growth despite regulatory challenges in China. Samsung’s decline is also linked, in part, to growing competition from other Android manufacturers. Ryan Reith from IDC noted, “The overall Android space is diversifying within itself,” with brands like OnePlus, Honor, Google, and others offering competitive devices at more affordable price points. Additionally, the appeal of foldables and on-device AI capabilities is capturing consumer interest.

Alongside the transition from Samsung to Apple, Chinese manufacturers Xiaomi, Oppo, and Transsion experienced robust growth, expanding their market share in 2023. This strength was propelled by increasing demand in emerging markets and the availability of competitively priced devices. As the global smartphone industry exhibits signs of recovery from a challenging 2022, competition seems to be intensifying. While Apple currently holds the lead, Samsung and ambitious Chinese competitors are poised to make determined efforts to regain ground in 2024.