Types of fraud in banking : Year 2024

3 min read

A astonishing 5 percent of corporate revenue is lost to fraud every year which more than US$4.5 trillion. And these frauds are growing day by day.

Below are few common and very frequently used banking frauds.

- Push payment social engineering

- Romance scams

- Business email compromise

- Invoice fraud

- Investment scams

- Telephone scams

1. Push payment frauds often arises from social engineering tricks

Social engineering and basic telephone tricks can also deceive victims into transferring funds to the fraudsters.

For example, A panic situation is created and victims is told that their account has been compromised and they must transfer the money to a new account to prevent it from being stolen.

Authorized push payment (APP) is a major contributor to global fraud losses, with the Asia-Pacific region reporting a most of fraud cases. This type of fraud often involves social engineering and impersonation tactics. In the UK, instances of APP fraud is up by 22 percent in the first half of 2023 compared to the same period in 2022, as reported by UK Finance team. UK people faced substantial losses due to APP fraud, totaling £485 million in 2022 and an additional £239.3 million in the first half of 2023. The Federal Trade Commission highlighted in February 2023 that American consumers lost US$2.6 billion to imposter scams in 2022, an increase from over US$2.3 billion in the last year.

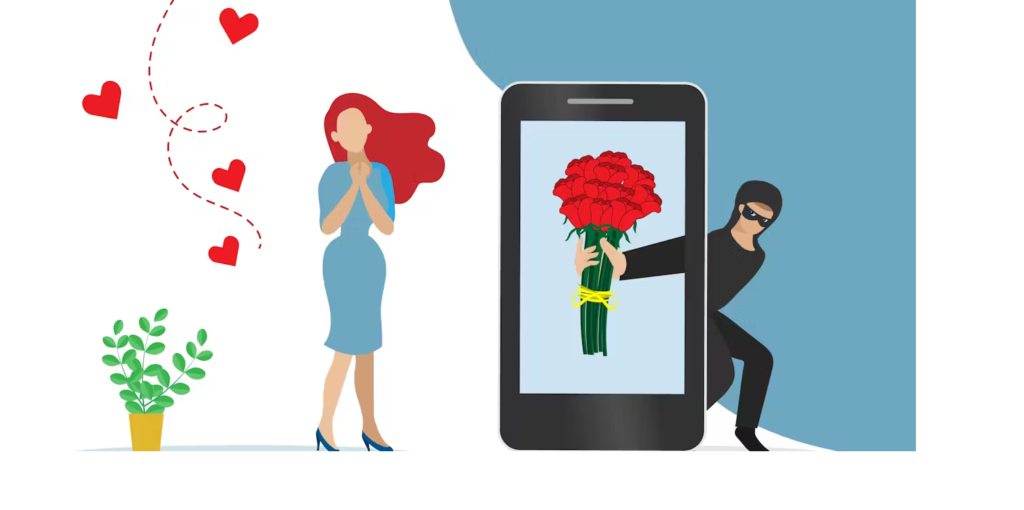

2. Romance scams

Romance scams typically involves the victim being contacted through text messages, emails, or social media to start a long-distance relationship. However, there is a recent trend where AI-powered image-generation software is used to conduct video calls with victims by creating deepfake videos.

The fraudster communicate with the victim via a video call, presenting the appearance of the individual in the still photo. The AI-driven software animates the deepfake image, allowing the scammer to appear on their video camera, with the victim seeing the deepfake avatar speaking their words and copying their facial expressions in real time.

After gaining the victim’s trust, the scammer then asks for money transfers to facilitate their travel to the victim’s country, clear debts, or unfreeze a locked bank account. In a recent UK case, a woman in her fifties lost £350,000 due to deepfake video calls where the scammer proposed marriage. She withdrew funds from her pension after the scammer falsely claimed to be held hostage and tortured due to outstanding debts.

3. Business email compromise – Email Phishing

Fraudsters commonly target businesses by posing as a high-ranking executive. They send an email to an employee, either from the victim’s compromised email account or from a fake email address. This email is often accompanied by a phone call, from the senior executive, instructing the recipient to act promptly. Deep fakes are now being utilized more frequently for video or voice calls. Typically, the email requests a significant payment to a fraudulent account under the guise of an urgent or sensitive matter, such as an employment guarantee.

4. Invoice frauds

Fraudulent invoices, purportedly from a genuine supplier, are emailed to the company, complete with bogus payment details. This type of fraud poses significant challenges for smaller businesses lacking real-time detection controls, relying on non-specialist, junior staff to manage payments.

5. Investment frauds

The surge in online investors increased since the onset of the Covid-19 pandemic, partly due to remote work arrangements. Consequently, criminal groups have established fraudulent investment websites to deceive individuals seeking to invest in stocks, commodities, and cryptocurrencies. These websites are promoted to general public through phishing emails and online advertisements on social media platforms. Similar to romance scams, investment frauds have seen a significant rise in the Asia-Pacific region recently.

According to the FBI’s Internet Crime Complaint Center, approximately US$3.3 billion was lost to investment scams in the US during 2022, the latest year for which full data is available. In the UK, victims reported losses exceeding £114 million in 2022 and an additional £57.2 million in the first half of 2023, as per UK Finance report.